Kush Bank PLC -an indigenous financial institution in South Sudan, has opened a new branch in Gumbo- Sherikat of Rajaf Payam, Central Equatoria state, to promote financial inclusion among the South Sudanese and business fraternity as a whole.

This brings the total number of branches across the country to seven (7). The tally includes Yambio, Wau, Bor, Mingakaman, Agok, and KonyoKonyo.

The latest branch brings a big relief to the community in Sherikat as now they can access affordable banking services from Kush Bank without the inconvenience of long-distance travel for transactions.

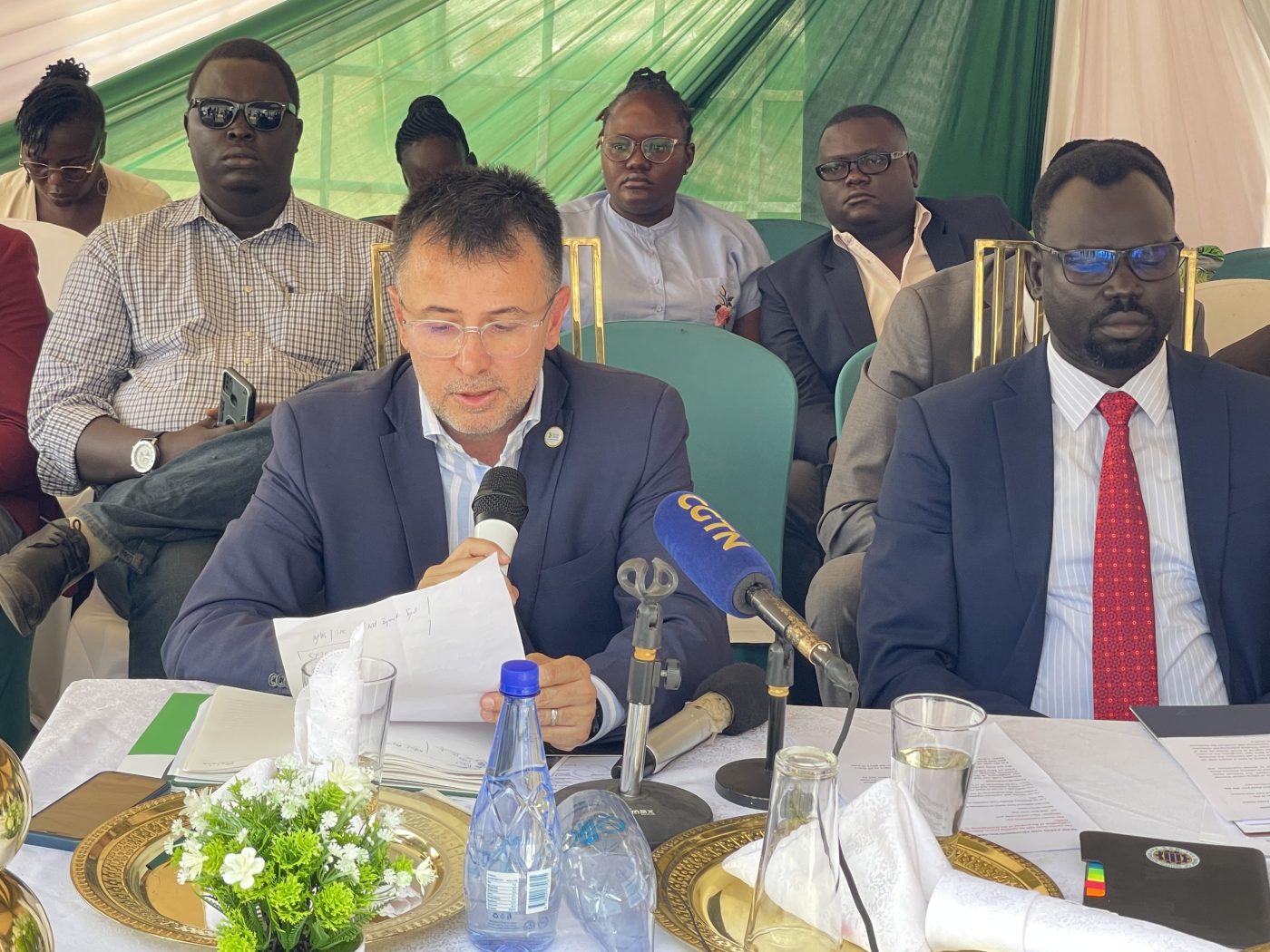

Speaking during the launching ceremony in Sherikat on Wednesday, Armando Massiliano, the Chairperson of the Board of Directors at Kush Bank, said that the financial institution was determined to contribute to socioeconomic development across the country.

“As one of the leading financial institutions in the country, we see our role as not only bankers or financial- related operators but contributors to nation-building. We are committed to socioeconomic development – and today, this is proven by the opening of this branch that our customers requested, and we brought for them,” he said in an opening remark.

Banking in any community is an essential service because it provides an efficient, secure, and reliable way of managing one’s business.

He reiterated that Kush Bank’s clients in Sherikat can operate their accounts from anywhere in South Sudan, where there is a Kush Bank branch, and even more conveniently, through mobile and internet banking.

“You can deposit money at the Sherikat branch and withdraw it in Yambio or other places. For business people, this is very convenient,” he underscored.

Globally, the primary role of financial institutions is to intermediate between those that provide funds and those that need the funds, typically transforming and managing risk.

Armando said, “At Kush, we are highly committed to improving your financial needs to support economic development”.

Last year, Kush Bank introduced No-Fee Banking services, making it the first bank to offer free banking deposits and withdrawal services across the country. This means that the bank does not charge its customers for withdrawals and deposits.

Armando stressed the importance of this, saying that “This is one of our many initiatives to promote financial inclusion for all across South Sudan, and we are in it so that we resolve financial gaps among the South Sudanese”.

However, the Deputy CEO, Mohamud Nur said that Kush Bank is continuously developing solutions to support financial inclusion and the government’s efforts to improve the lives of the people of South Sudan.

“The financial solutions and banking products offered by Kush Bank, including fee-free deposits and withdrawals, mobile and internet banking, trade finance, project financing, and much more, are all designed with the South Sudanese in mind. They help address the daily financial challenges faced by businesses and individuals.”

He added that Kush Bank is committed to Corporate Social Responsibility (CSR) and the advancement of the SDG goals relating to social wellness and the reduction of poverty among the people.

Meanwhile, Bank of South Sudan, Dr. Addis Ababa Othow, Directors and Shareholders, Local Payam Chief, Community Leaders, Business Community leaders, representatives from Learning institutions, Kush Bank staff, ladies and gentlemen, good afternoon.

On behalf of Kush Bank PLC and on my own behalf, I would like to welcome and appreciate all of you for taking the time to witness this great occasion, the launching of this new branch – Sherikat.

“As one of the leading financial institutions in the country, we see our role as not only bankers or financial-related operators but contributors to nation-building and development – and today, this is proven by this branch that our customers requested and we have brought Kush banking services to Sherikat,”.

He added that the Banking in any community is a very essential service because it will provide an efficient, secure, and reliable way of managing your business. For instance, most of our customers on this side of the city won’t be spending money to go and deposit or withdraw from our branches in town or locations that are far from them. You can deposit money at the Sherikat branch and withdraw it in Yambio. For business people, this is very convenient.

Globally, the primary role of financial institutions is to intermediate between those that provide funds and those that need the funds, typically transforming and managing risk. At Kush, we are highly committed to improving your financial needs to support economic development.

Kush Bank Commitment

At Kush Bank, we realize that we are doing business in a nation with the lowest financial inclusion in the world and with the highest number of women-led households. As such, we have taken up a commitment and have made it our mission to ensure that with products like No Fee Banking, we break down the barriers to the financial inclusion of vulnerable groups and those excluded from the financial system.

In our work, we would like to resolve your financial difficulties and turn them into positivity. Having financial challenges means being unable to meet financial-related needs. However, with Kush Bank PLC, we are continuously developing solutions to support financial inclusion and the government’s efforts to improve the lives of the people of South Sudan. These include policies that grant individuals and businesses access to useful and affordable financial products and services, including mobile and internet banking, trade finance, and much more.

Additionally, the bank is committed to Corporate Social Responsibility (CSR) and the advancement of the SDG goals relating to social wellness and the reduction of poverty. Through many of our partnerships with organizations such as the Future Stars Football Academy, Koneta, the Catholic Diocese, and Brilliant Academy, among many others, we are heavily invested in Corporate Social Responsibility (CSR) initiatives to ensure an all-round corporate contribution to the growth of development of South Sudan.

We believe it is our duty as a financial entity to promote socioeconomic development across the country.

Finally, I would like to encourage all the South Sudanese and young people, in particular across the country, to join hands in working for sustainable and economic development. Prioritize managing your assets efficiently and it will be better through our financial products.